Credit Card Services Now Available and Digital Wallets Coming Soon

Credit card services are now available. Digital wallets including Apple Pay®, Google Pay™, and Samsung Pay® for your new CCU credit card are coming soon as we continue working with Visa Services to ensure Digital Wallet functionality is fully enabled. We appreciate your patience and encourage you to check back for updates.

Welcome KCT to CCU!

All members now have access to an expanded network of branches and ATMs throughout northern Illinois. Visit our Locations page to explore all the places you can bank with us. For first-time login instructions and more, see below.

Digital Banking Login

- First-time login here.

- View our First-Time Sign-On video.

- Need help? Call us at 877.275.2228.

- Download our mobile app for Apple or Android.

Digital Banking Checklist

- Download the CCU digital banking mobile app

- Update your digital banking bookmark

- Verify your accounts are visible and accurate

- Enter your digital banking security settings and alerts

- Enter your alert preferences

- Activate your new cards

- Re-establish future and recurring Credit Card payments

- Enter your e-statement preference (print is selected by default)

- Check your future and scheduled payments and payees

- Set up your savings goals and spending analysis

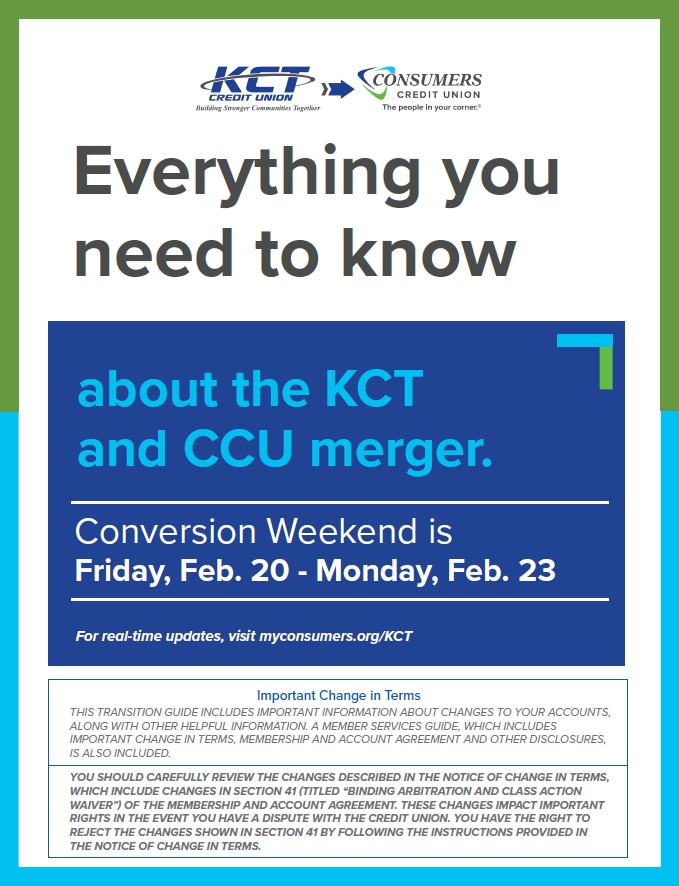

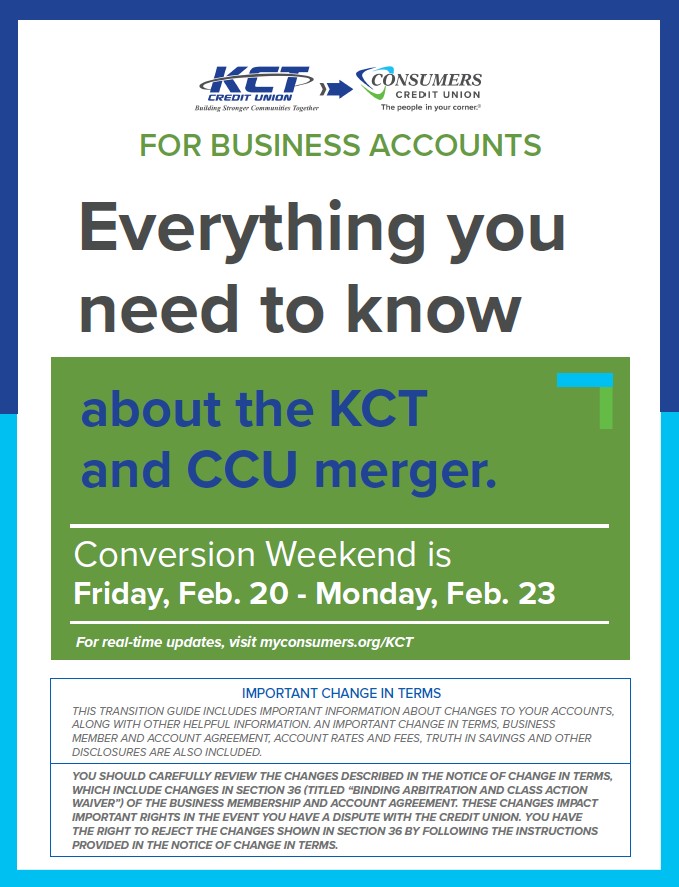

This is your complete guide about the KCT & CCU merger.

New Digital Banking Features for KCT Members

- Zelle®(retail accounts only)

- Chat with support team

- Credit Card integration (no longer a separate KCT digital Card app)

- Receive Instant Payments (via participating financial institutions)

- Integrated Credit Card features

- Search Digital Banking FAQs

- Submit & Track Disputes

- Stop Payment for Checks

- Open Accounts Online

- Apply for Loans Online

- Send Wires

- Order Checks

New Digital Banking Features for KCT Business Members

- New business dashboard with specific business banking features

- Add additional users with different levels of access

- Business Wires *

- Business ACH *

- Positive Pay *

- Check scanning capability with higher limits

- Business Mobile Deposit *

- Statement Uploads

More information and frequently asked questions about your new Digital Banking experience

How do I log in for the first time?

The first time you log in, you’ll use your KCT digital banking Username and your current password, then fill in the requested information. For your security, you will need to complete an additional multi-factor verification for your first login. If you would like to change your login credentials, you may do so afterward. If you haven't accessed digital banking recently, you may need to register as a new user.

How do I register? I never used digital banking with KCT

If you haven't used KCT’s digital banking or mobile app previously, click here to get started.

Did my existing account information transfer over?

Your account information has been transferred over. We strongly recommend that you review closely. If you notice any discrepancies, please contact us immediately at 877.275.2228

Did my existing alerts and controls carry over?

Why am I not receiving push notifications?

Do I need to update existing transfers, bill payments or automatic payments?

Will I need to update credit card payments for my new CCU card?

Yes, you will need to re-enter your payment details to ensure they continue as expected.

- Log in to CCU Digital Banking

- Click on your credit card account

- Select Make a Payment

- Follow the prompts to set up your future or recurring payments

How much transaction history, e-statements and bill pay information will carry over?

Transaction history that will be carried over into Digital Banking:

- Checking accounts = 1 year

- Savings accounts = 6 months

- Certificate accounts = YTD

- Loans - Life of loan or all available

- Retirement accounts = YTD + 1 Yr

- 2 years of e-Statement History will carry over

- Bill Pay history will not carry over

How to log in to digital banking, beginning February 23

Smooth your transition. Start with your first-time sign-on.

Additional information about this merger

Direct Deposit Timing

Will I still receive early access to my direct deposit?

Yes. CCU provides the same early access KCT members are used to.

What if I don’t see my deposit at the usual time?

The timing of payroll and Social Security direct deposit notifications isn’t controlled by CCU and can vary based on several factors. While deposits are still processed the same day, they may post at a different time than they did at KCT.

Does CCU hold my funds?

No. Deposit notifications are processed as they are received.

Do withdrawals or debit payments post early?

No. Withdrawals and debit transactions post on their scheduled date to help prevent unexpected overdrafts.

Setting up New ACH Payments or Direct Deposits

- Consumers Credit Union routing number: 271989950

- Your CCU account number for the selected loan or deposit account

How to find your account number:

- Log in to Online or Mobile Banking

- Go to the Accounts section

- Select the loan or deposit account

- The number shown is your full account number to use for ACH or direct deposit

Will I keep my KCT Member Number?

Home Mortgages & Home Equity Lines of Credit

Auto & Personal Loans

Member Statements

Starting Monday, February 23, you’ll need to re-enroll for electronic statements. Once you have logged into CCU digital banking, select the Statements & Documents menu option and follow the steps. Or call us for assistance at 877.275.2228

Dividends and Statement Dates: For the period February 1 - 20, dividends will be paid, and a special statement will be generated for that time by KCT. In the first week of March, you’ll receive your first CCU statement, which will include dividends paid for February 21 - 28.

ATMs & Cash Access

Branch Access

Member & Account Numbers

Support for Payroll Transfers will be Ending 2/20/26

Deposit Based Transfers will no longer be supported

After February 20, these deposit-triggered transfers and loan payments will stop working. Your paycheck will still deposit as usual, but the related transfers and loan payments will not occur unless they are set up as Scheduled Transfers in CCU Digital Banking after conversion.

To set up Scheduled Transfers within CCU Digital Banking starting February 23:

- Log in to CCU Digital Banking.

- Look for the option titled “Move Money” in the main menu.

Start by selecting the account you want to transfer money from, and then the account you want to transfer money to. - Enter the amount you’d like your transfer to be, then, under the “Send Transfer” drop-down menu, choose “Scheduled”. This will allow you to select a future start date and set the frequency of your transfer – such as weekly, biweekly, or monthly.

Note: You can also add a memo with info about your transfer in this section if you like. - Once everything is set, click Review, then Confirm Transfer to complete the setup. Your automatic transfers will now process going forward based on the schedule and information that you have provided.

KCT Branch Closures and Digital Banking Availability

- Unavailable on Friday, February 20

- Restored Monday, February 23

- Closed on Saturday, February 21

- Reopen on Monday, February 23

- Unavailable on Saturday, February 21

- Resume on Monday, February 23

Why Is This Merger Happening?

The combination of the two companies ensures a bright future for members and employees of both institutions. Members will have access to a larger branch network, enhanced digital tools and a broad range of products and services.

When Will This Process Be Complete?

We are planning for KCT to complete the transition to CCU systems, Monday, February 23, 2026.

What If I Have Current Accounts At Both KCT And Consumers Credit Union?

For members with current accounts at both institutions, KCT and CCU accounts will be preserved through conversion, along with any associated credit or debit cards. For example, a member who holds a checking account with a debit card at KCT, as well as a checking account with a debit card at CCU will continue to have two separate checking accounts, with two cards after the system conversion is complete.

What Should I Be Doing Now To Prepare?

- Double-check your contact information and make sure your mailing address, e-mail address and phone number(s) are correct. Make any necessary updates through Online Banking, by visiting any KCT branch location or by filling out the Change of Address form located on the KCT website. Note that a valid, updated ID is required to change your address in person at a branch.

- Visit and bookmark this merger landing page: www.myconsumers.org/KCT

Digital Banking Discontinued Features

- Spanish language option will no longer be supported.

- Certain transfer frequencies may not be available.

- Check images will only be accessible within your digital banking account history. They will not appear in your new eStatements.

- KCT Digital Card App (DCA) will be discontinued. Card details and management will be integrated into CCU Digital Banking.

- Business external transfers must be re-enabled through our Business ACH feature. Please contact CCU Treasury Management for assistance.

- P-Card management will be available in Business 360 instead of Spend Clarity.

What If I Have More Questions?

Merger Communications

- April 3, 2024: Press Release

- October 31, 2024: Legal Merger Letter and Attachments

- October 31, 2025: Merger Update Later

- January 26, 2026: KCT Merger HELOC letter January 2025

Click here to share your thoughts on the information on this page

For personal assistance, call us directly at 877.275.2228